All Categories

Featured

In 2020, an approximated 13.6 million U.S. houses are recognized capitalists. These families control huge wide range, approximated at over $73 trillion, which stands for over 76% of all personal wealth in the united state. These investors take part in investment chances usually not available to non-accredited financiers, such as financial investments secretive business and offerings by particular hedge funds, private equity funds, and equity capital funds, which enable them to expand their riches.

Review on for details regarding the most recent accredited financier revisions. Financial institutions normally money the bulk, but hardly ever all, of the resources called for of any acquisition.

There are mostly 2 guidelines that allow issuers of protections to use limitless amounts of safety and securities to capitalists. 2021 accredited investor. Among them is Policy 506(b) of Policy D, which enables a company to sell safety and securities to limitless accredited capitalists and approximately 35 Advanced Capitalists just if the offering is NOT made via basic solicitation and basic marketing

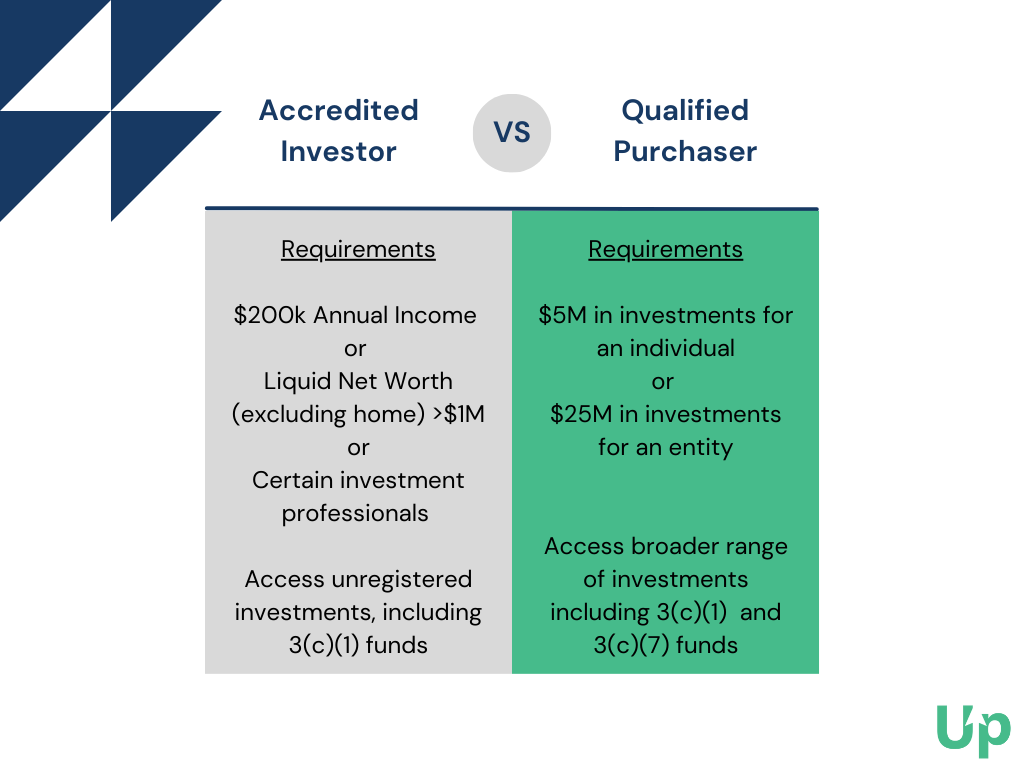

The freshly adopted modifications for the very first time accredit private investors based on economic refinement needs. The changes to the recognized financier interpretation in Policy 501(a): include as recognized capitalists any trust fund, with complete possessions much more than $5 million, not developed specifically to acquire the subject protections, whose acquisition is directed by a sophisticated person, or consist of as accredited investors any entity in which all the equity proprietors are certified financiers.

And now that you recognize what it suggests, see 4 Realty Advertising methods to bring in accredited capitalists. Internet Site DQYDJ PostInvestor.govSEC Proposed changes to interpretation of Accredited InvestorSEC improves the Accredited Capitalist Interpretation. There are a number of registration exemptions that ultimately broaden the universe of possible capitalists. Many exemptions require that the investment offering be made just to persons that are recognized capitalists (how to be an accredited investor).

In addition, recognized investors typically obtain more beneficial terms and higher potential returns than what is available to the basic public. This is because personal positionings and hedge funds are not required to abide by the exact same regulatory demands as public offerings, permitting even more versatility in terms of financial investment techniques and potential returns.

Accredited Investor Qualification Form

One reason these protection offerings are restricted to recognized capitalists is to guarantee that all getting involved financiers are monetarily innovative and able to fend for themselves or maintain the danger of loss, hence making unneeded the defenses that come from a registered offering.

The net worth examination is reasonably straightforward. Either you have a million dollars, or you don't. On the revenue examination, the person should please the thresholds for the 3 years constantly either alone or with a partner, and can not, for instance, please one year based on private revenue and the following two years based on joint earnings with a partner.

Latest Posts

Buying Delinquent Tax Property

2020 Delinquent Tax List

List Of Properties That Owe Back Taxes